How We Helped SprintMoney to Design & Develop a One-of-a-kind FinTech App for the Indian Market

Project Scope

To enable corporates and individuals with an investment solution dealing in Mutual Funds, insurance, tax planning, etc

Scale

Integration with one medium-sized bank

Inception:

Duration:

Current Status:

On hold after phase 1 for Beta user validation

Team:

1 Engineering Manager

1 Product Manager

1 Principal Designer

1 UX designer

1 Mobile App developer

1 Full stack developer

1 Back-end developer

Introduction

Valued at USD 31 Billion, the Indian FinTech market is currently the third largest FinTech market in the world, right after the U.S. and China. With over 1.49 billion installs of FinTech apps (between January 2019 and March 2021), India is also home to the highest number of FinTech adopters in the world. At 87%, the country well surpasses the global benchmark of 64% post-pandemic.

Against this backdrop, we at Digicorp were thrilled to bag our first Fintech Project in August 2020, when the co-founders of SprintMoney reached out to us.

SprintMoney is a one-of-a-kind FinTech app that democratizes personal finance by creating a smart marketplace for personal finance products like Mutual Funds, Insurance, Loans, etc. These products are largely from small and localized financial institutions in India. Unlike other similar apps currently available in the market, SprintMoney’s unique distribution strategy entails onboarding end customers via tie-ups with institutions like corporates and financial institutions, instead of reaching out to the public directly.

Here, we chronicle our ongoing journey of building this innovative product from scratch and implementing a robust data architecture and design strategy to make the app a success.

Problem Identification

Since SprintMoney happened to be our first foray into the world of FinTech, we started with extensive domain research at the outset. This was coupled with detailed discussions with the client to understand their goals and objectives.

With over 100 years of combined experience in the fields of Finance and IT, the co-founders had a clear vision of what they were trying to do. By having focused and in-depth discussions with them and by combining their insights with the findings from our domain discovery process, we identified 5 parts to the problem that SprintMoney wants to solve:

The existing FinTech apps in the market are great for customers who are already well-versed in the purchase and usage of various financial products like investment products, loan products, and insurance products. However, there are currently no suitable apps for those looking to start their financial journey from square one. This means that there is a lack of financial inclusiveness even among end customers who have a decent disposable income and are eager to improve their financial health with the help of FinTech apps.

Small banks and localized financial institutions often have excellent financial products and services that can benefit end customers. But they do not have the infrastructure and resources to create a marketplace of their own or host their products on renowned online marketplaces for financial products. This is because deep-pocket financial institutions like large banks with nationwide operations can easily out-shine them over there.

Apps similar to SprintMoney that are currently floating in the market do not integrate seamlessly with the in-house IT systems of potential institutional buyers. For example, if a corporate organization wants to enable their employees’ financial freedom by integrating such a marketplace with their HRMS software, they need to invest significant time, money, and IT resources to achieve the same.

The recommendation engines of existing FinTech apps take a one-size-fits-all approach. The customers are given a standard set of options instead of providing them with choices that truly match their stage in life, their demographic and geographic parameters, and their overall financial journey. To remedy this challenge, the owners of SprintMoney wanted to devise a solution that has a powerful and sophisticated recommendation engine that helps even customers with little or no financial knowledge.

Last but not the least, the process of buying and using any investment, insurance, or loan product is often a complex process involving various steps, extensive documentation, and massive amounts of complex data. Together with the founding team of SprintMoney, we at Digicorp envisioned an all-in-one FinTech marketplace that drastically simplifies the overall process, integrates all data from customers and third-party service providers, and substantially reduces the time taken to complete the documentation burden.

Our Approach

1. Feature Engineering

We started by conducting a detailed comparison between 5 apps that are similar to SprintMoney in terms of their core offerings. We mapped the features that they were excelling in while paying special attention to gaps and challenges that were left unaddressed by those apps.

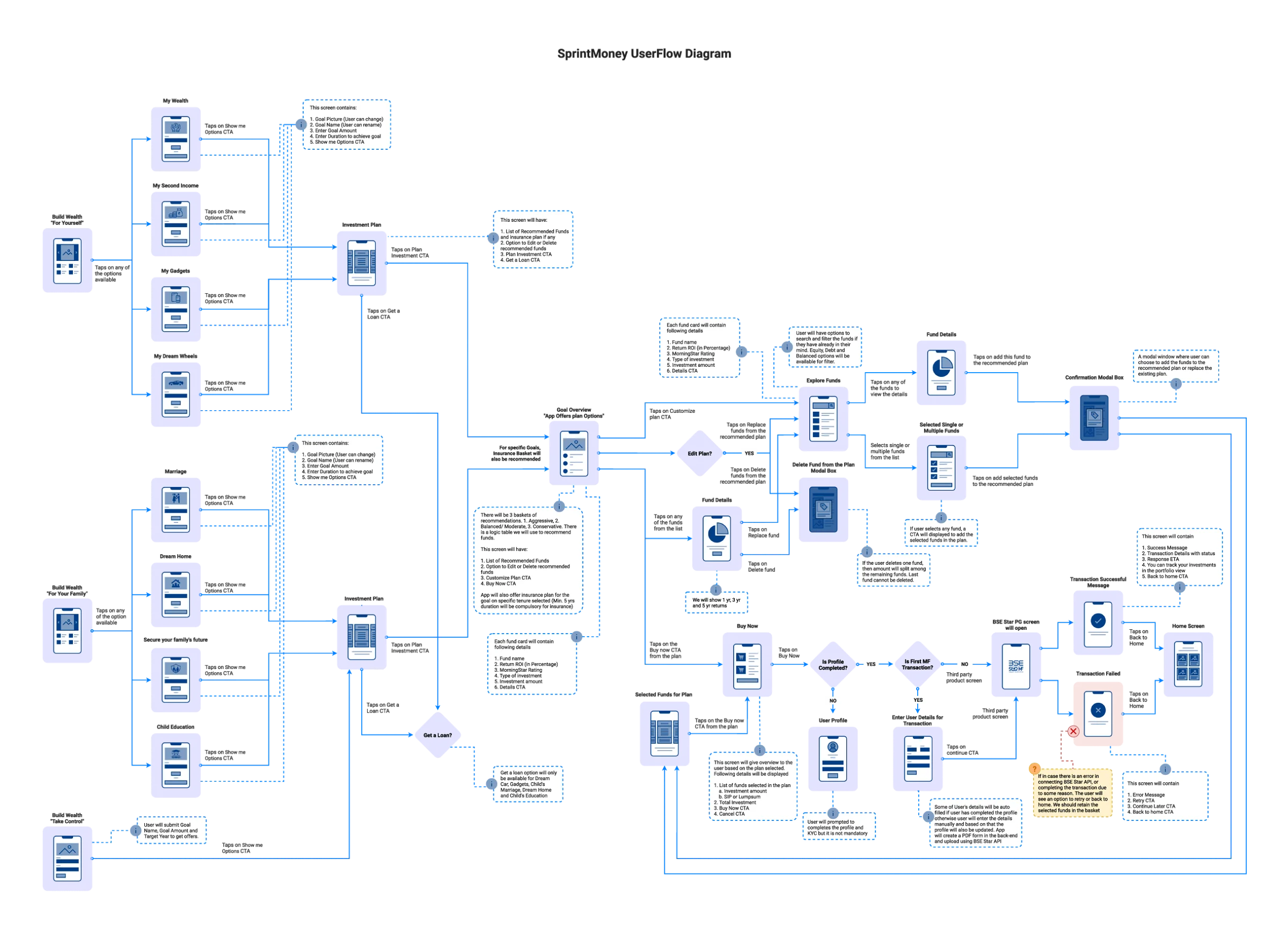

An important realization that we arrived at was that when it comes to deciding on the final purchase of a financial product, the end-user usually goes through a step-by-step process. It hardly ever happens in one go. This means that from the point when the first user interaction takes place to the point when she/he finally makes the purchase, multiple touchpoints are involved where the user can lose interest or become demotivated to make the transaction. We have designed SprintMoney in such a way that at each of those touchpoints, we nudge the user gently to return to the application and resume their journey towards financial freedom – right from where they had left off.

To do this, apart from researching the right design elements to keep the user hooked, we also built features and incentives all across the users’ purchase cycle such that the chances of a user returning and eventually making a purchase on the platform are dramatically improved.

Besides, SprintMoney was divergent from other apps in one core area – that is, they were not reaching out to end-users directly but were going through various institutions instead. Hence, we built the app in such a way that the features benefit not only the end customers but are also useful and easy to use for the institutions that serve as distribution partners and channel members for SprintMoney.

This way, we seamlessly aligned SprintMoney’s features with the distribution strategy that the founders had adopted. This was a major element of the entire design and development process since investment companies, banks, insurers, and corporate organizations are the key to maximizing the market penetration for SprintMoney.

2. Data Integration

FinTech apps don’t function in a vacuum. They need to “talk” with the entire ecosystem encompassing the Finance and the Economics of a country. For example, in the case of SprintMoney, the tech discovery process revealed that a large number and variety of data points had to be integrated and assimilated within the app’s data processing module.

This data was massive, complex, and diverse, coming to SprintMoney at uneven rates from customers as well as third parties like AMCs (Asset Management Companies), Stock exchanges like BSE, rating agencies like Morningstar India, and BSE Star MF, RTAs (Registrar and Transfer Agents), and so on.

For example, when it comes to Mutual Funds (MF), data points like shareholding percentage, valuation (Net Asset Value (NAV)), and current prices are important considerations. Other data points reveal the statutory limitations on transactions, like the specific dates on which MF transactions can happen for a given bank or institution, the nature of MF (lumpsum vs SIP) allowed during a given period, restrictions that decide which schemes are allowed to be under SIP (Systematic Investment Plan), and performance ratings of various schemes and funds.

During the early stages of developing the app, integrating data from such diverse and disparate sources presented a challenge of its own. Some of this data, like pricing-related data, were also time-sensitive and had to be fed to the system in a matter of a few milliseconds. We achieved the same by incorporating a data lake instead of a Relational Database Management System (RDBMS) which was our initial approach. Using the data lake that we specifically architectured for SprintMoney, we seamlessly integrated large volumes of structured and unstructured data and retrieved the same within a few milliseconds to enable spotless financial decision-making and smooth transactions. Using the data lake also substantially reduced the application’s time-to-query and improved the overall efficiency and performance to a great extent.

3. Data Validation

FinTech apps are susceptible to fraud and data breaches all the time. This makes data validation an extremely critical component of the app development process. In particular, interacting with certain third-party entities like BSE Star MF required interfacing through APIs for aspects like identity verification, payment integration, and transaction processing.

Since it is cumbersome and time-taking for the end-users to keep migrating from one system to another, we decided to make the entire transaction process an integral part of the application itself. Hence, intermediate steps like verification of Personal Account Number (PAN), and verifying the validity of images uploaded by the end-user (like images of self, images of canceled cheques, etc.) all happen within the native application environment of SprintMoney. Further, extracting details like account number, branch name, and IFSC code from uploaded images or documents have all been automated in order to save transaction time and any possibilities of error.

We achieved these by using advanced capabilities like image processing and OCR, and also with the help of external services like Amazon Textract. Apart from auto-validation, back-end users of SprintMoney can also query the data internally to perform supervised validation (for example, they can check if the bank branch details entered by the user match the IFSC number extracted from the canceled cheque or not).

A number of steps like verifying account name, account number, and PAN number happen through auto-validation right at the time of profile creation on SprintMoney. This eliminates the need for independent verification on platforms like BSE Star MF (for example, separate validation is not required outside of SprintMoney for submissions under the Foreign Account Tax Compliance Act (FATCA), which is a rather complex and time-consuming process). At present, we are also working on adding added layers of security like Mobile Money Identification Number (MMID) verification which will further enhance SprintMoney’s data safety and system integrity.

4. Recommendation Engine

India is a vast country with a highly dynamic and diversified demographic. The fit between a financial product (like an investment product or an insurance product) and the end customer will depend on various factors like the customer’s location, age bracket, employment type, income level, and financial goals. For example, the service class consisting of working professionals between 25 to 45 years of age have a much higher financial risk appetite as compared to those above the age of 45 years.

Further, the usage patterns and financial goals of end customers residing in tier 1 and tier 2 cities are vastly different from those of end customers who are residing in small towns and villages. Based on the geographical location of the customers, the financial products which are popular or more acceptable to the natives in a certain region also vary significantly from those in other regions.

Since 75-80% of end users don’t know this industry, curating a useful and comprehensive recommendation based on the factors listed above along with other factors like investment needs, family background, education, employment status, and income level is a critical accomplishment that we have attained for SprintMoney.

SprintMoney’s mission is to assist even absolute beginners in their financial journey. This hinges on having a sophisticated recommendation engine in place that we have built and integrated within the app. At present, SprintMoney provides access to this feature to all users without any subscription fee, but going forward, they see this as their key selling point and IP (Intellectual Property).

5. Data Architecture

Digicorp undertook a deep tech-discovery process to understand the data architecture needs for SprintMoney. Thereafter, our team selected the technology stack accordingly. Right from the start, we focused on adopting a loosely coupled, modular architecture keeping in mind the extensibility needs that might arise in the future. Our microservices-based architecture has kept the application lightweight while all the functional domains – i.e. Investments, Insurance, and Loans – are kept modular.

This means that each functional domain can be independently deployed on any platform and be hosted on a separate infrastructure without the need to avail of other functional modules. For example, if a corporate only wants to have the insurance module for its employees, it need not avail of the investment and loan modules of SprintMoney.

The deployment has been done on the AWS cloud. By using cloud infrastructure and edge analytics of financial data, we have been able to ensure continuous integration and continuous delivery (CI-CD) in a seamless, hassle-free, and end-to-end manner. SprintMoney can also be deployed natively on institutional servers. Alternatively, a hybrid deployment model can also be adopted based on the users’ needs.

We have built multiple fail-safes so that all user interactions on the app follow the applicable data safety provisions. While many FinTech platforms save the transactional data to prevent transaction failures, we have directly paired SprintMoney with the relevant financial institutions so that transactions can happen on verified bank portals directly. As a result, no financial data needs to be saved on SprintMoney, and nor is it required to leverage escrows to enable the transaction from start to finish.

Conclusion

At present, we are in the process of adding many more features to SprintMoney. Together with the client team, we are on the path to making it a leading FinTech app in the country. Digicorp is your trusted partner to build apps that wins consumers, dominate the market, and grow effortlessly. Our world-class capabilities in design, technology, and product engineering make us your ideal choice for building a new product from scratch or upgrading an existing one. Know more about our projects and capabilities here, write to us at sales@digi-corp.com to boost your journey of product innovation!