FinTech APIs Reshaping the Financial Landscape

Table of Contents

API or Application Programming Interface is a set of instructions developers deploy, allowing two or more applications to interact. These miniature and independent programs enhance an application or software’s functionality.

An API represents a standardized protocol ensuring secure communication between a bank’s server and mobile device. Instead of writing all the code from scratch, the APIs help organize the code, making the application components reusable.

Fintech APIs are specifically designed to initiate communication between financial transactions and processes. These APIs can simplify several financial functions like payment processing, financial regulation, and data aggregation, among others.

An Overview of FinTech APIs

APIs connect different systems to an application for granting access to data and functionalities. All financial organizations can use APIs according to their needs and requirements.

Fintech applications leverage APIs to connect with different pre-built functionalities. For instance, if an app needs to verify a user’s identity, an API can be used to connect the app to a secure database and verify the identity of a user.

Moreover, when the applications need payment processing functionality, they can again use an API to verify details, process the payment, authorize, and complete the transaction.

Fintech companies also need to follow heaps of regulations for different services. However, by using Banking-as-a-Service (BaaS) services through API calls, companies can use the banking services without going through exhaustive processes.

Without using a fintech API, the developers have to write the code scripts for the entire process. Moreover, maintaining and scaling a fintech application built without APIs will take more time and effort.

How do FinTech APIs Connect the Backend with Frontend?

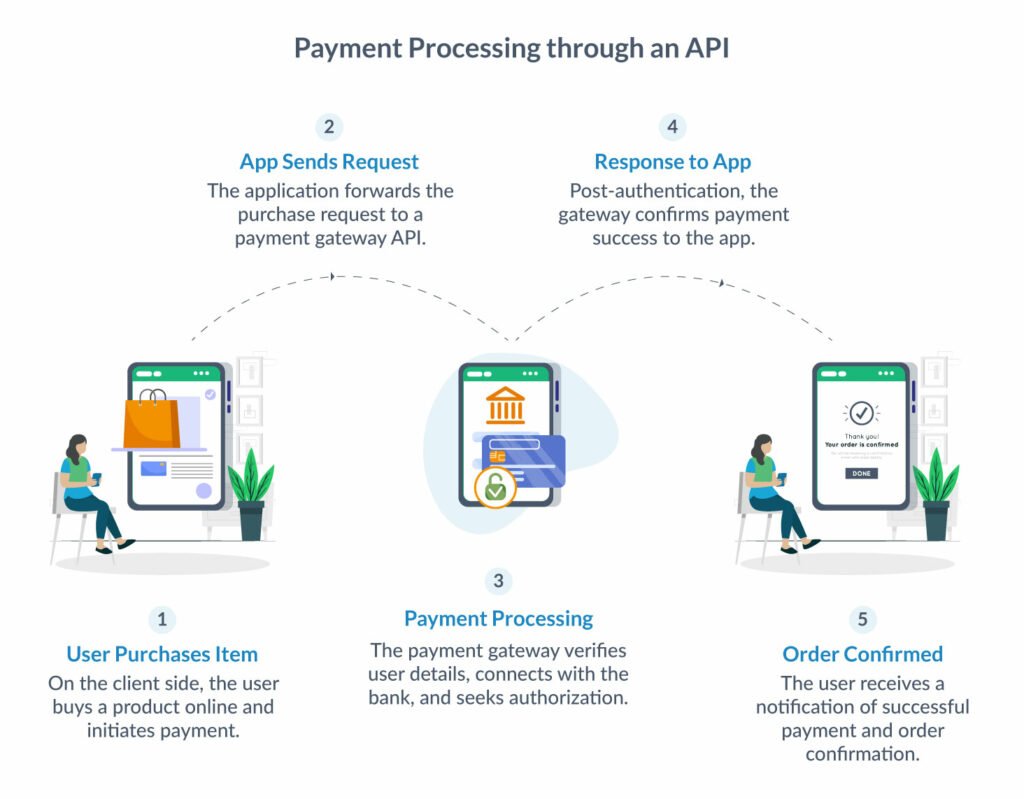

Fintech APIs build bridges between different systems in the ecosystem. Here’s an example of payment processing through an API.

APIs help complete the entire process with speed and efficiency. For a developer to write the code for this process may take hundreds of working hours, which will also increase the development cost.

A similar process is followed for other purposes, including credit score checks, identity verification, getting investment recommendations, etc. For each purpose, the gateways and database API access are different, which is why there are different types of fintech APIs available.

These APIs orchestrate a smooth flow of information and data among different systems. They bring several technical and business advantages.

Advantages of FinTech APIs

Fintech APIs are an integral part of every fintech application because of the advantages they offer.

Reduces Development Costs

APIs allow developers to build the application on a microservices architecture where different components of the application are connected via APIs. Due to this, individual application features work as independent components. They are developed and debugged separately; any changes in one component won’t affect the other. Hence, this also reduces the development costs.

Increases Development Speed

Using APIs, developers can speed up the development process as they source pre-built code scripts for specific functionalities. These APIs extend the possibilities of a fintech application without compromising on the work quality.

Helps Stay Compliant

APIs help fintech companies stay compliant with strict regulations. For a fintech application, following several local and international compliances is essential.

Some APIs also have automatic updates, ensuring that your application remains compliant. However, make sure to check if the fintech API you are going to use is compliant with your local laws and regulations.

Improves Customer Experience

APIs can take care of several functions in an application, but the end goal of all these services is to improve user experience. Faster payments, easy information access, etc., contribute to enhancing customer experience.

Better Security

The fintech APIs are built with multiple encryption protocols. They safeguard the information while it is in transit or at rest. Moreover, APIs have a granular control over user permissions, ensuring tighter security.

Applications built with APIs can easily block attempts to alter and edit the source code preventing data theft.

These advantages demonstrate the potential of APIs in building secure, performant, and user-centric fintech applications. To harness the best benefits of your fintech API, take some time to identify the type of API you need and assess its benefits to make a better decision.

Different Types of FinTech APIs

Fintech APIs can handle a wide range of functions for fintech applications. Fintech APIs can be segregated according to functionality, from handling payment transactions to identifying users and checking credit profiles.

Financial Data Aggregator

Payment processor

KYC & Identity Verification

RegTech & Compliance

Authentication & Authorization

Trading APIs

Credit & Reporting

Financial Data Aggregator

Financial data aggregators unlock financial information, accessing data insights that banks and financial institutions can use to deliver personalized experiences. These FDAs become intermediaries between the fintech application and data source.

FDA Fintech APIs connect the applications with banks, credit bureaus, and other platforms. APIs acting as digital diplomats get access to financial data while ensuring security and regulatory compliance.

FDA APIs store data, which fintech application developers can use to understand customer preferences and requirements. As a result, the developers can add features and functions to build personalized user experiences.

Examples of FDA APIs

Plaid API

Plaid API helps aggregate financial information for all types of institutions without letting them interact with the backend systems. It fetches the required information without needing to access all the data stored on the servers.

Use Cases

- Account Verification.

- Data collection for personalized experiences.

- Connect multiple user accounts like brokerage, retirements, banking, investments, etc.

Dwolla API

Information like customer identities, balance checks, money transfers, bank account verification, etc., is facilitated through Dwolla.

Use Cases

- High-speed Automated Clearing House (ACH) and bank transfers.

- Cash flow management and money management.

Payment processor

Payment processing APIs enable digital payments and transactions between the user’s banks and the merchants. These APIs acquire, validate, and process payments within a few seconds.

Fintech app users can easily make domestic and international payments depending on the API deployed for this purpose. These APIs ensure the requisite security and encryption to secure the user’s financial information.

Payment processing fintech APIs facilitate payments from credit and debit cards. They also orchestrate the flow of payment transfers through e-wallets, bank transfers, and mobile payments.

Examples of Payment Processor APIs

Stripe API

A global payment processing platform, Stripe API works in over 135 countries and has flexible subscriptions.

Use Cases

- eCommerce online payments.

- Subscriptions and billing for recurring services.

- Offers currency exchange price in real-time.

Square API

Square API offers a seamless omnichannel payment system to brick and mortar stores as well as online stores.

Use Cases

- Payment processing for online wallets and POS.

- Offers real-time analytics to businesses.

PayPal API

It is a highly trusted payment processing API with built-in business-friendly features and a dispute resolution mechanism.

Use Cases

- Built-in invoicing payment systems.

- Automated billing cycle for subscription-based services.

KYC and Identity Verification

Know Your Client (KYC) APIs set the foundation for a secure and transparent financial system. Fintech companies use KYC API to verify customer’s identity and prevent fraud. These APIs bring down the time to verify a user’s identity from days to minutes and ultimately increase operational efficiency.

KYC APIs are used for onboarding new users and loan application processing. These APIs verify the documents submitted by users by tapping into government databases, open banking data, and credit bureaus.

Acting as digital watchdogs with access to multiple authentic databases, these APIs help build a secure ecosystem. In addition to the general functions, KYC APIs also help with anti-money laundering activities and identify suspicious behavior.

These APIs help foster trust and build relationships between users and organizations, including fintech.

Example of KYC and Identity Verification API

Truiloo API

With access to global databases, Truiloo API streamlines identity verification and document validation. It helps businesses satisfy KYC and Anti Money Laundering regulatory requirements.

Use Cases

- Secure user onboarding to enhance the KYC process.

- Facilitates cross-border transactions with thorough user verification.

RegTech and Compliance

Regulatory Technology or RegTech APIs simplify the regulation requirements for fintech companies, ensuring compliance. These APIs stay updated with the changes in regulations and emerging compliance requirements while keeping the fintech companies informed about the same.

They help generate compliance reports, audit reports, and risk management assessments specific to the organizations working with the APIs. RegTech API identifies compliance risks to ensure proactive compliance, giving the companies enough time to take action and make informed decisions.

Well-built RegTech APIs have the highest standards of security and privacy to store and safeguard sensitive information.

Example of RegTech API

ComplyAdvantage API

This API automates compliance checks for financial institutions. It helps update the in-house policies to align with the global standards and practices. It helps fintech companies implement the changes as the API never stops updating its systems.

Use Cases

- Update and effectuate AML processes and compliances.

- Optimize risk management by assessing financial crime risks.

Authentication and Authorization

Cybersecurity attacks are increasing by the day in terms of quantity and sophistication. Authentication and authorization APIs integrate into the fintech applications and build a robust security structure.

From biometric authentication to two-factor authentication, these APIs add multiple layers of security. They provide services like secure sign-in, social login, and fraud detection through granular access control.

Moreover, these APIs ensure security through session management like logging out inactive users after some time and preventing unauthorized access.

Through secure logins and tight security, these APIs improve user experience while safeguarding the application and user’s sensitive information.

Example of Authentication and Authorization API

AuthO API

AuthO API provides secure access to the applications and platforms. Through its cloud-based identity and access management (IAM) system, AuthO API offers a variety of authentication and authorization systems offering secure access to the users.

Use Cases

- It supports several authentication methods like access token, client ID and client assertion, enterprise identity providers, and passwordless authentication.

- Helps streamline authorization through access control rules and permissions.

Trading APIs

Trading APIs replace a human broker for buying and selling assets on the market. These APIs have pre-trained market knowledge and have customizable settings to suit the user’s requirements, trading habits, and expectations.

They ease trading experiences by accessing real-time market data and calculating decisions while catering to the user’s requirements

Users can deploy built-in algorithmic trading sequences, leading to automated execution. Trading API allows your users to trade 24/7 while pursuing their financial goals.

Example of Broking and Trading API

Alpaca API

Alpaca API allows developers to build and integrate trading bots into trading applications. It can help build programs to analyze market trends and manage portfolios. Using this API, developers can add support for automated strategies and build a feature that provides real-time market insights, which is beneficial for the end-users and streamline their trading activities.

Use Cases

- Offers a risk-free trading platform like paper trading.

- It offers 24/7 access to trading for crypto and extended access for other forms of trading.

Credit and Reporting

Credit and reporting fintech APIs facilitate credit score checks to streamline loan application assessment. With access to user’s data, fintech companies and financial institutions can complete risk assessments for faster loan approval and offering personalized loan products.

Examples of Credit and Reporting API

Experian API

Experian API offers insights into a user’s financial behavior, lending, and credit history, helping lending institutions make informed decisions.

Use Cases

- Risk assessment through credit score analysis.

- Offers KYC and AML regulatory compliance checks.

Fintech APIs of all types bring in multi-faceted advantages. All types of APIs reduce development time and costs. They make it easier to stay compliant and enhance security, improving user experiences.

Plus, each fintech API has some unique advantages as well. The KYC APIs benefit from frictionless onboarding, and the RegTech API helps automate report generation and compliance.

Different companies have built standalone APIs based on different types. These APIs are easy to embed in the applications and help complete the requisite functions.

Leading Companies Leveraging FinTech APIs

Choosing the right API is essential to harness the advantages fintech APIs offer. With a multitude of options available out there, let’s go through how some of these fintech APIs are used by large companies.

| FinTech API Type | FinTech API Name | FinTech Apps Using the API |

| Payment Processor API | Stripe API | Shopify, Slack, Instacart, Netflix, Spotify, Patreon |

| Banking and Financial Data Aggregator API | Plaid API | Coinbase, Venmo, Acorns, WellsFargo |

| KYC and Identity Verification API | Trulioo API | NortonnLifeLock.Co, Revolut, Monzo, TransferWise |

| Credit and Reporting API | Experian API | Kyckr |

| Trading and Broker API | Alpaca API | Airwallex, Invest Sku |

| RegTech and Compliance API | Comply Advantage API | Currency Cloud |

| Authentication and Authorization API | OAuth API | Mastercard, Facebook, Twitter, PayPal |

Our Proven Expertise in API Integration

As the fintech sector is ever-evolving, navigating through the complexities of API integration is difficult. However, Digicorp boasts years of experience in API integration.

Here are a couple of examples demonstrating Digicorp’s prowess in API integration.

FilsPayment

| Client | FilsPayment. It is a platform that offers multiple online payment services like mobile wallets, QR code payments, making online payments, etc. The application has built-in security features like multi-factor authentication and has a user-friendly interface. |

| The need for FilsPayment | The Kuwait government has authorized online payment to a sole gateway, KNET. Any business wanting to process online payments must go through numerous regulations, which unnecessarily increases costs and effort. On the other hand, integrating KNET’s core functionality with the application was also a challenge due to its intricate structure and unintuitiveness. |

| How we addressed the challenge? |

To solve this issue, we built a developer-friendly wrapper with public APIs. This wrapper allows FilsPayment to access KNET’s core and process payments seamlessly on web, mobile, and eCommerce platforms. The wrapper solution was advantageous as being connected to the KNET meant FilsPayment complies with the Kuwait rules by default. Moreover, the wrapper made building a bridge with the KNET core API easier without getting troubled by its intricacies. The simplified solution resulted in a smooth user experience. |

| What we learnt? |

The Kuwaiti rules and regulations tied out the client’s hands as they could not afford to spend the time and money on getting all the licenses and compliances in order. It was a new experience for our team to innovate a solution that allowed our clients to stay within the budget and get the results they desired. The API framework allowed us to leverage KNET’s existing infrastructure to deliver our client’s expected results. |

SprintMoney

| Client | SprintMoney It aims to improve financial inclusion and banking among the unaddressed audience. The application offers a platform to invest in mutual funds, SIP, and manage finances. |

| Challenges | SprintMoney had plans to provide all tax planning, mutual funds, insurance, etc. on a single application. However, the challenge was to build all the features and functionalities from scratch and then bring them together on a single platform. The wide array of services demanded a robust integration system with APIs to process data and deliver the solutions. |

| How we addressed the challenge? | Digicorp’s design and development team structured the application to leverage the power of APIs to ensure seamless functionality. We delivered a harmonious blend of API solutions, including;

|

| What we learnt? | It was a big opportunity for us to take on this project and learn more about the power of APIs. Clearly, using a wide range of APIs is pivotal to creating unified platforms with multiple functions. |

Leveraging the power of fintech API requires an in-depth understanding of its functionality and limitations. Digicorp helps businesses deliver the best services to their customers through interactive designing and intelligent development, including using APIs for different purposes.

Working on these projects was an amazing experience for the team. We innovated new ways to deliver the required functionality, discovering them through brainstorming sessions, discussions, and A/B testing to find the perfect solution.

Choosing the Best FinTech API

APIs are the crucial bridge applications used to build connections with different functionalities. However, it’s essential to choose the right APIs, which requires careful consideration.

With every organization and application working to build a unique solution based on their market research, they must choose APIs that harmonize their application functions.

At times, API integration must take a different approach, like we did with FilsPayment and other times, the process is simple but needs a robust symphony of all the APIs working together, as we did in SprintMoney.

The selection of the fintech API depends on your requirements, purpose, and the challenge you are facing. At Digicorp, we have the expertise to decipher the needs and use the perfect APIs to fuel your application’s development and growth.

Conclusion

As the financial industry evolves, the integration of new technologies, services, and functionalities will become essential. Building advanced applications to deliver innovative solutions is easier when fintech companies use APIs as digital connectors.

When planning to integrate APIs into your application, identify their potential to forge new connections and relationships to craft new possibilities. Work with Digicorp as we identify the power and potential of these APIs to help you build smart, secure, and interactive applications for your users.

Vivek Navadia

- Posted on January 31, 2024

Table of Contents