A Detailed Guide to Building a FinTech App

Table of Contents

According to McKinsey, the fintech industry will grow three times faster than the traditional banking sector between 2023 and 2028. This heightened customer interest in the fintech industry is catalyzed by the entry of innovative products and solutions in the market.

If you have plans to launch your fintech application in the next couple of years, this is the ideal time to start the development process. We have created a comprehensive guide to assist you in building a fintech application.

Use this guide to learn all you need to consider for building the best fintech business application.

Decoding the FinTech Landscape

To get some context, let’s take a look at the past performance of the fintech sector. Until July 2023, publicly traded fintech companies had a market cap of $550 billion, a two-fold increase from the 2019 value.

Another report published by Boston Consulting Group finds that by 2030, the fintech sector is expected to generate a revenue of $1.5 trillion. Currently, Fintech takes care of only 2% of global financial services, but by 2030, it will constitute 25% of all banking valuations.

Fintech service providers and organizations that take swift action to leverage this potential can generate vast profits.

Emerging Markets Will Show Significant Growth in the FinTech Industry

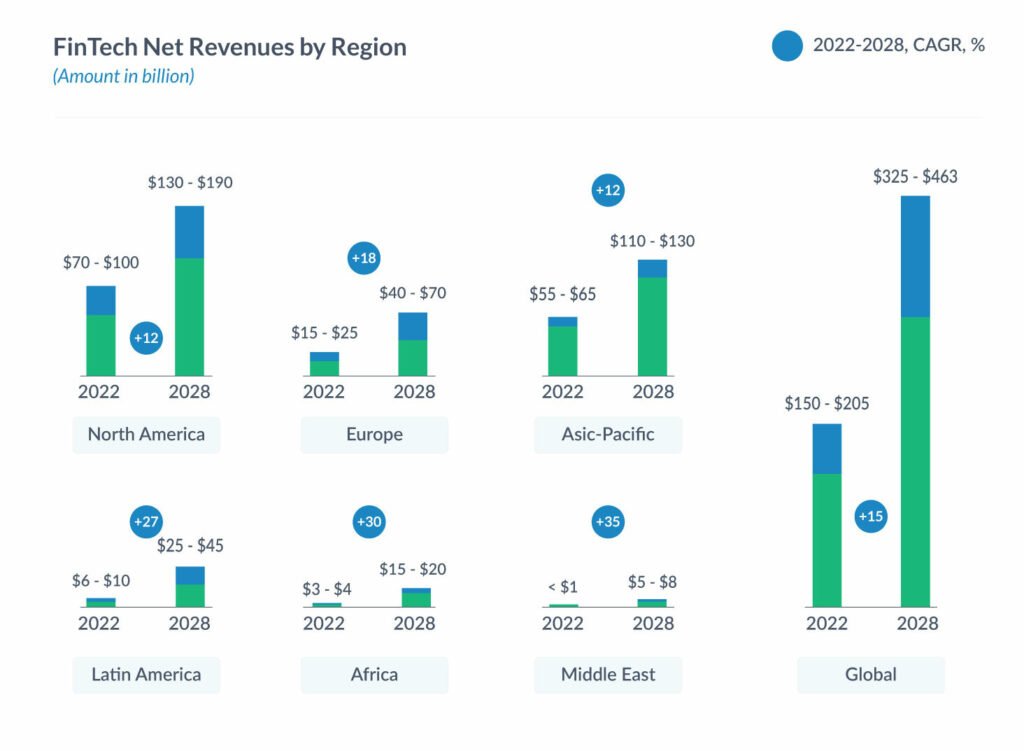

Across the globe, the fintech industry is expected to grow substantially well in the next five years. The figure below illustrates the expected growth rates of all the continents.

Source: McKinsey

For the founders to take advantage of the fintech sector’s growth, they must account for the upcoming industry trends.

Three Trends That Will Shape the Future of FinTech

As you are planning to build the next generation of fintech applications, identify the key trends and integrate them into your application. Modern technologies will allow you to build user-centric and relevant applications.

Here are three trends to consider as you plan to build a fintech application.

Sustainable Digital Finance

Sustainable digital finance is the merger of ESG (environmental, social, and governance) principles with financial technology. Any fintech product or service launching from 2024 must account for sustainability.

It will create immense value for the brand, further making it a champion of social inclusion and environmental friendliness.

AI in FinTech

The upcoming fintech applications will look to integrate artificial intelligence into their workings. Be it for improving the user experience, better analysis, or any other purpose, using AI within the set boundaries can become challenging for businesses.

At the same time, financial regulators and systems will keep an eye on how fintech companies manage AI’s implications. So, if you are planning to build a fintech company, leverage AI systems to ensure user security and, in turn, avoid any sort of censure.

Financial Services Within the Metaverse

As the trend of virtual worlds grows, specific advancements will be made in the metaverse system. Fintech organizations can explore integrating virtual reality (VR) into delivering financial services, creating a personalized user experience.

In the B2B segment, Fintech organizations can provide VR training to their client’s employees in the metaverse.

With these trends and growth potential in mind, Fintech startup founders will get a better direction for the future. Using the research and trends analysis, you can find the unique aspects to focus on for building your fintech startup and a market-ready product.

Types of FinTech Applications To Choose From

When planning to build a fintech startup, choosing the right type of application is pivotal to success. The fintech industry has evolved to a great extent with lots of niches emerging with specific purposes and individual growth potential.

Digital Payments

Digital payment applications are allowing people to go cashless, and the scope of scaling these applications is enormous. These applications allow users to send and receive money instantly and safely.

Applications like Apple Pay, Paytm, and Venmo are some examples.

This represents a shift towards a cashless society. In the absence of cash, digital payment applications allowing people to make small to large payments digitally will increase.

Digital Banking

Digital banking applications allow users to operate their bank accounts and use several financial services from their mobile. These applications are helping change the banking dynamics, leading to better financial inclusion. Furthermore, using them, the users won’t have to visit physical bank branches.

Examples of digital banking applications include Chase App, Bank of America, Starling Bank, etc.

- These applications offer services like opening bank accounts, transferring funds, taking loans, and investing in fixed deposits, among other services.

- Users can benefit from instant access to their funds and take out statements as easily as downloading a file from the web.

With the convenient services available through mobile applications, digital banking will continue to grow in the future.

InsurTech

Insurance technology (InsurTech) is a subdomain of fintech specifically catering to the insurance sector. Insurtech applications allow users to access insurance-related information, submit claims, and furnish details.

Examples of Insurtech applications are Acko, Slice, Friendsurance, Knip, simplesurance, among others.

- Insurance companies use Insurtech applications for risk assessment, insurance services, and more.

- These applications can be integrated with wearables, IoT devices, vehicle telematics, drones, etc., for targeted and customized service delivery.

- Insurtech applications make it easy to reach out to potential customers and increase the insurance coverage net.

Insurance companies leverage big data and artificial intelligence to assess an individual’s risk profile based on the information provided through the application.

When planning to build Insurtech applications, focus on one niche first, like cars, health, property, etc. Integrate specific advanced technology, like telematics for cars, to deliver smart and authentic service experiences to the users.

Investment Apps

Investment applications work with the motive to ease the investment process by allowing anyone to invest with a few clicks. Using these applications, users get instant access to the information they need without depending on intermediaries.

Examples include SoFi, Betterment, Wealthfront, etc.

- Investment applications ease the investment process by adding Robo advisors deployed through chatbots.

- They provide personalized recommendations by harnessing artificial intelligence and machine learning to assess a user’s profile.

You can build investment applications specifically for beginners, experts, and capitalists. Within the investment application domain, you can also diversify to add more investment options like cryptocurrency, NFTs, and other commodities.

Payment Processing

Individuals using credit or debit cards to make payments have to pass through different steps to reach the merchant. Payment processing applications reduce the number of steps and time required to make the payment. PayPal and Wise are two of the most prominent payment processing fintech applications allowing businesses and end-users to send & receive payments from across the globe in a simpler manner.

Payment processing applications take a middleman’s role in connecting the credit card companies with the customer’s credit card information. These applications ease the delivery of financial services, making them accessible to anyone and everyone using cashless payment methods.

Personal Finance

Personal finance applications are meant to help individuals better manage their finances. These AI-powered applications act as financial advisors, forwarding recommendations and advice to users based on their financial profiles, goals, and requirements.

Examples are Mint, You Need a Budget, and Spendee.

- Personal finance applications centralize the user’s financial information in one place.

- Users can track and manage their spending which leads to reformative changes in habits and ensures a better financial position.

- These applications share trends and opportunities with the users that they cannot exploit or discover.

Personal finance applications advise and inspire users to have better creditworthiness. These applications also provide credit score information and help users follow credit-building practices.

For all types of fintech applications, the integration of modern technologies like machine learning and artificial intelligence, among others, is pivotal to success. Driven by innovation and advanced technologies, Fintech applications are evolving to offer better solutions to their customers.

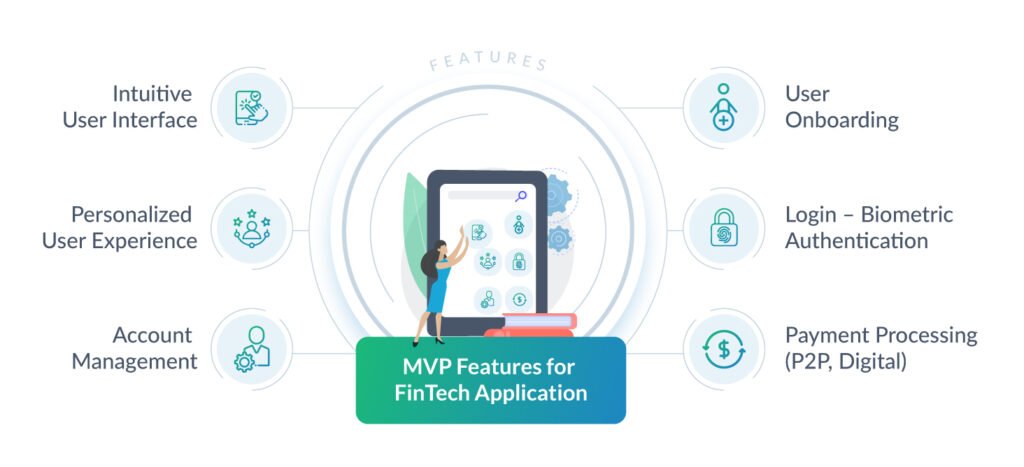

Must-Have Features for Your Fintech Application

As we have explored the diverse range of fintech applications to choose from, it’s evident to select the best features for the applications you are planning to build. The right set of features will transform your application from a simple program to an indispensable tool for the users.

Let’s go through the features you must include when building a fintech application.

User Onboarding

A smooth and seamless user onboarding process is paramount to creating a positive user experience. From a streamlined account creation process, user authentication, and personalized process guidance, enhanced onboarding improves application adoption.

Login – Biometric Authentication

Biometric authentication establishes a strong sense of security within the users. At login, give users the option to use biometric authentication to access the application, and every time the application closes, the biometric sequence must run again.

Biometric authentication uses unique biometric identifiers like facial recognition, fingerprint scan, voice recognition, etc. to allow access, which ensures financial information of the users won’t be accessed by anyone but themselves.

Payment Processing (P2P, Digital)

Frictionless and secure payments help users send and receive money through the application. Payment processing is required for almost all types of fintech applications.

This feature allows users to make payments through their mobile phones and set up automated recurring payments without visiting the banks. To further enhance your application’s accessibility and usability, integrate multiple payment gateways.

Users must find it convenient to make payments with credit cards, debit cards, and mobile wallets. Moreover, Fintech applications can also explore integrating payment service providers (PSPs) like PayPal, Apple Pay, GPay, and Amazon Pay, among others.

Account Management

Account management contributes to building a convenient user experience. From intuitive dashboards to frictionless fund transfer, transaction history, and setting funds limits, account management features allow users to navigate easily.

Aim for a system whereby the users can effortlessly oversee their account, which fosters trust and enhances overall user experience.

Personalized User Experience

Personalization plays a significant role in improving user experience. The application shall suggest functions and products according to the user’s preferences, send promotional offers on their birthday, and provide personalized insights.

These functionalities allow users to stick with your application as it provides an enhanced user experience. Personalization appeals to every user individually, which in turn increases conversion rates.

Intuitive User Interface

An application’s user interface must be simple, intuitive, and convenient. It should be user-friendly, allowing users to navigate through the app easily. A disjointed user experience due to a cluttered and complex interface leads to abandonment. Make it easier for the users to find services, search, and take action.

Advanced Features for FinTech Application

Chatbots (Driven with AI and NLP)

Chatbots driven by artificial intelligence and natural language processing provide instant and personalized customer support. The context-driven support system personalizes the customer service experience as it addresses customer queries quickly and efficiently.

AI-driven chatbots provide personalized recommendations, increasing satisfaction and conversion rates.

Real-time Analytics and Reports

Fintech applications offer real-time analytics and reporting, allowing users to view visualized reports, analyze their spending, and track investment performance. Users can also monitor cash flow trends, which helps them avoid sudden or unplanned expenses and make informed financial decisions based on data-driven insights.

Thanks to real-time reporting and analytics, users can detect any potential fraud, anomalies, or market fluctuations and proactively protect their accounts and assets.

Integration with Other Financial Apps

Fintech applications are easier to work with if they are integrated with other applications that enhance their functionality. Users must be able to connect with other financial applications for budgeting, accounting, payment transfers, etc.

Ensure that the application you build has seamless interactivity. Efficient integration offers a cohesive digital experience for the users and helps them manage finances easily.

Investment and Wealth Management Tools

Wealth management and investment tools help users to manage wealth through investments. Integrating investment and wealth management tools within digital banking and payment processing applications can open up new avenues for your users to use the application for multiple purposes.

The users can access a wide range of investment opportunities within the mobile application. In addition, integrating educational resources within the application helps users make informed decisions.

As the industry grows, Fintech organizations will experience a progressive need to integrate new features and functionalities. So, for a fintech organization to progress ahead, regular updates are required to stay relevant and resilient. Therefore, stay updated with the latest trends and latest industry developments.

FinTech Application Development Process

From the above sections, it is evident that this is an ideal time to enter the fintech market with an innovative solution. However, to build a market-ready product, startup founders need to follow a set of proven development processes.

Determine App Type and Niche

As we have discussed, you have a wide range of options available to build applications in the fintech domain. Choosing one niche is essential to build a customer-oriented application.

While choosing a niche, consider the following;

- Personal banking and insurance applications require more time and resources. Hence, they are relatively more expensive.

- Personal finance and lending applications require fewer resources, but they need a robust security infrastructure.

- Investment and stock-related applications are information-intensive and help complete basic investment-related actions. These apps can be built with APIs, which allows for easier changes.

Using this information and more research, build a plan for a specific type of application.

Comprehensive Market Analysis

A thorough market analysis specific to the fintech application type you will build is essential. Given the dynamic characteristics of the financial ecosystem, startup founders need a plan to ensure long-term success.

Pay close attention to the application’s market fitness, customer preferences, and competitor analysis. Fintech applications that can successfully address the market gaps and fill in the customer needs have better chances to succeed.

Create Customer Personas

User or customer personas help the design and development team familiarize themselves with the ideal real-world users of the product. User personas allow the design and development team to empathize with the end-users.

Collect data of your ideal customer to develop personas and make sure to include their preferences. Adding common frustrations and pain points gives you an upper hand over competitors as your application will address the end-user’s specific needs.

Based on the customer personas, you can add specific features and functions to address the requirements.

Team, Tech Stack, and Business Model

With a thorough understanding of the application type and customers, you need to choose the team with the right skills and expertise. In your team, ensure having a quality developer, UI/UX designer, QA specialist, and a project manager.

With the help of the team and technology experts, choose the appropriate tools and technologies for development, designing, database, testing, deployment, and quality assurance.

As you adopt the tech stack and build an apt team, you should also have a strong and proven business model in place for the success of your fintech application.

Check Compliances and Regulations

Fintech applications record and store sensitive user data. Ensuring proper security of the gathered data is essential to building a trustworthy application. Here are a few regulations you need to follow;

- Data Regulations: Fintech applications need to follow the rules and guidelines set in GDPR and HIPAA to ensure secure and lawful processing of information. However, HIPAA is only applicable to fintech applications processing healthcare data.

- Know Your Customer (KYC): KYC compliance is essential to identify users, detect fraud, and satisfy the anti-money laundering requirements.

- Cybersecurity Measures: For safeguarding sensitive user data, Fintech applications must protect unauthorized data access and implement advanced encryption. In addition to this, run security audits and incident response plans to effectuate a secure environment.

- PCI DSS Compliance: Fintech applications processing payments need to comply with PCI DSS regulations mandatorily. It sets the rules for the secure storage, processing, and transmission of cardholder data.

While the global compliances and regulations are better advertised and known, also keep an eye on the local and regional regulations you are supposed to follow. Like in the United States one must also comply with FTC and EFTA regulations before launching a fintech app.

Once all the details are finalized, it’s time to move on to the step that is going to take the most time and effort for building a fintech application.

MVP Design, Development, and Testing

Create a user-friendly, simplistic, and modern application design for your application. Once designed, the application goes into the coding process. Prefer creating a modular code architecture as it ensures easy scalability and testing of the application.

Add fintech APIs to improve application functionality and reduce development time. Review the code for bugs, performance issues, and glitches. With the help of quality assurance experts, ensure code styling, formatting, structuring, and organization. Check the application’s performance on all devices and platforms on which you are planning to deploy it.

Building a potent fintech application requires careful planning, thoughtful designing, adhering to compliances, and advanced coding practices.

At Digicorp, we follow agile development methodologies to design and develop scalable and resilient fintech applications. Work with us to build the best possible fintech application for your business and prepare to lead the industry with innovative solutions.

Leverage Our Experience and Expertise

Digicorp has a history of experience in building fintech applications. Our association with the fintech industry has allowed us to build an adaptive understanding of the industry workings and figure out the best way to build a future-ready application.

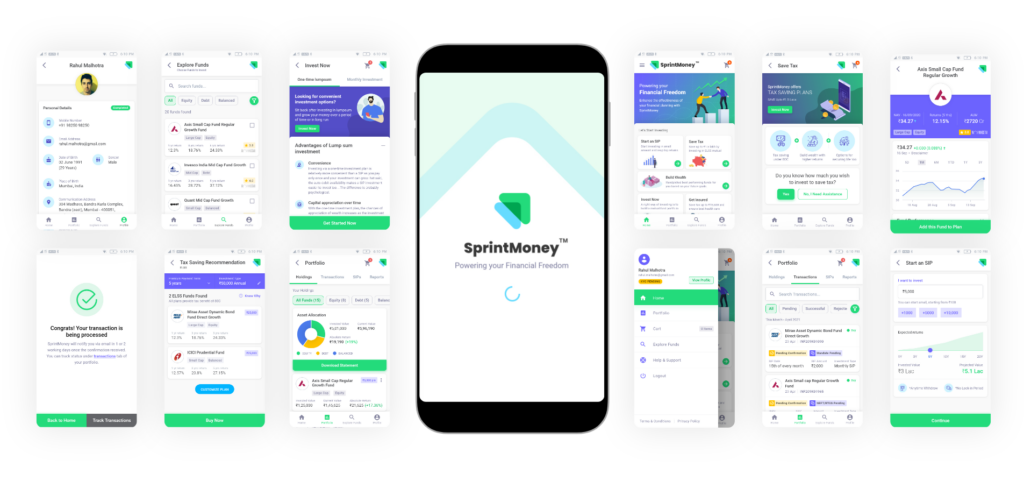

Using our expertise in the fintech sector, we have successfully designed, developed, and delivered SprintMoney. It is a one-of-its-kind personal finance application allowing users to invest in mutual funds and buy life insurance from their mobile.

Working with SprintMoney’s mission of financial inclusion for everyone, we built a recommendation engine to share user-specific recommendations based on age, risk appetite, and the amount the user wants to invest.

We utilized a microservice-based architecture to make the application lightweight and modular. This enabled independent deployment of each domain, meaning that corporations could opt for specific modules of SprintMoney, such as the insurance module for employees, without requiring the investment or loan modules. We also utilized other technologies, including creating a data lake to fetch data in microseconds and implementing OCR and image processing for data validation. Additionally, we made sure to have an intuitive UI-UX at every touch point to make sure that the user completes the transaction without dropping it midway. Read the complete case study on the fintech application-building process.

To Sum It Up

Fintech brings the best of technology to the financial sector, creating new ways for end-users to complete transactions, invest, learn, and grow their capital. To develop a fintech application, startup founders need a visionary idea, creative design, and robust development to build an attention-grabbing application.

Digicorp’s design and development team has the expertise to understand your vision and create the best fintech application in the industry. Get in touch to know more.

Nachiket Patel

Co-Founder, VP (DIGICORP)

Nachiket Patel

- Posted on January 18, 2024

Table of Contents